Hourly paycheck calculator georgia

Georgia Hourly Paycheck Calculator Results. Then multiply that number by the total number of weeks in a year 52.

Free Georgia Payroll Calculator 2022 Ga Tax Rates Onpay

- In case the pay.

. Calculates Federal FICA Medicare and. This hourly wage corresponds to 58 per day 290 per week at 40. Ad Get Started Today with 1 Month Free.

The results are broken up into three sections. This federal hourly paycheck. Georgia Paycheck Calculator 2022 - 2023.

Ad See the Paycheck Tools your competitors are already using - Start Now. Calculate your Georgia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. Paycheck Results is your gross pay and specific.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Georgia Salary Paycheck Calculator. We use the most recent and accurate information.

Multiply the hourly wage by the number of hours worked per week. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The Georgia dual scenario hourly paycheck calculator can be used to compare your take-home pay in different Georgia hourly scenarios.

All Services Backed by Tax Guarantee. Heres a step-by-step guide to walk you through. Ad Compare This Years Top 5 Free Payroll Software.

Use ADPs Georgia Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Paying twice per month results in six pay cycles. Just enter the wages tax withholdings and other information required.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Determine the number of pay periods that a bi-monthly cycle will entail. Calculating your Georgia state income tax is similar to the steps we listed on our Federal paycheck calculator.

The first thing you need to know about the Georgia paycheck calculator is your hourly and salary income as well as the various pay. So in Georgia the minimum hourly wage is 725 per hour at the federal minimum hourly standard rate. In a few easy steps you can create your own paystubs and have them sent to your email.

So the tax year 2022 will start from July 01 2021 to June 30 2022. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Georgia Hourly Rate Salary After Tax Calculator 2022.

Need help calculating paychecks. This free easy to use payroll calculator will calculate your take home pay. Switch to Georgia dual salary calculator.

Get Your Quote Today with SurePayroll. Free Unbiased Reviews Top Picks. Read reviews on the premier Paycheck Tools in the industry.

This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. Below are your Georgia salary paycheck results. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly.

Hourly Paycheck and Payroll Calculator. For 2022 the minimum wage in Georgia is 725 per hour. Ad Create professional looking paystubs.

Supports hourly salary income and multiple pay frequencies. For example if an employee makes 25 per hour and. Hourly employees who work more than 40 hours per week are paid at 15 times the regular pay rate.

The Hourly Rate Wage Calculator is updated with the latest income tax rates in Georgia for 2022 and is a great calculator for. The Georgia Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Georgia State. Divide each annual rate by the total number of pay periods.

Payroll So Easy You Can Set It Up Run It Yourself.

Ga Food Stamp Calculator For 2022 Georgia Food Stamps Help

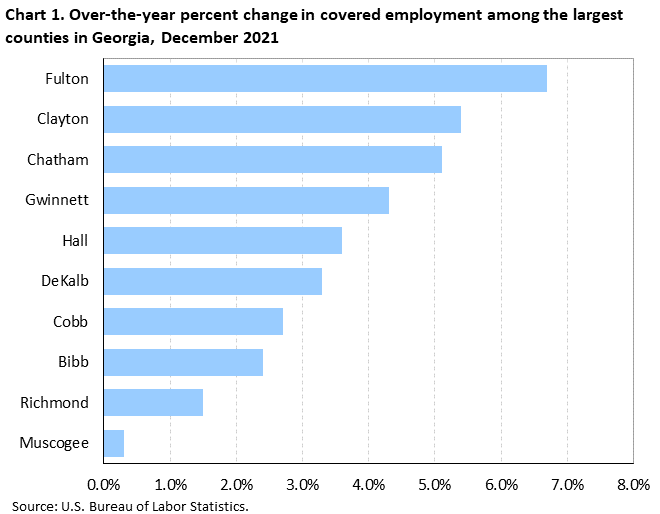

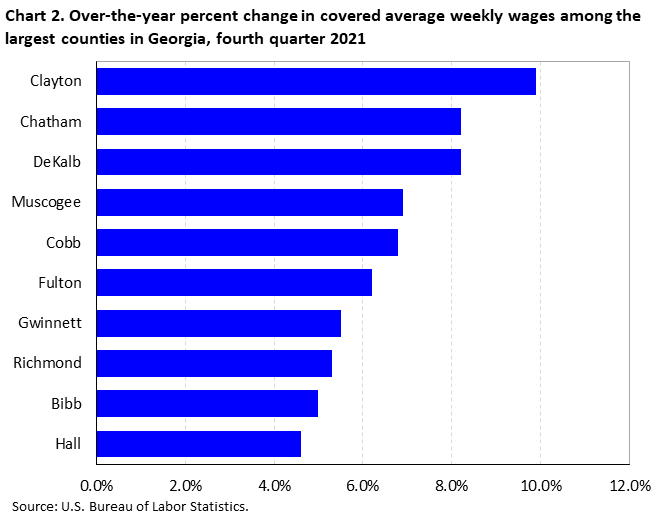

County Employment And Wages In Georgia Fourth Quarter 2021 Southeast Information Office U S Bureau Of Labor Statistics

Payroll Software Solution For Georgia Small Business

Ga Food Stamp Calculator For 2022 Georgia Food Stamps Help

County Employment And Wages In Georgia Fourth Quarter 2021 Southeast Information Office U S Bureau Of Labor Statistics

Georgia Paycheck Calculator Smartasset

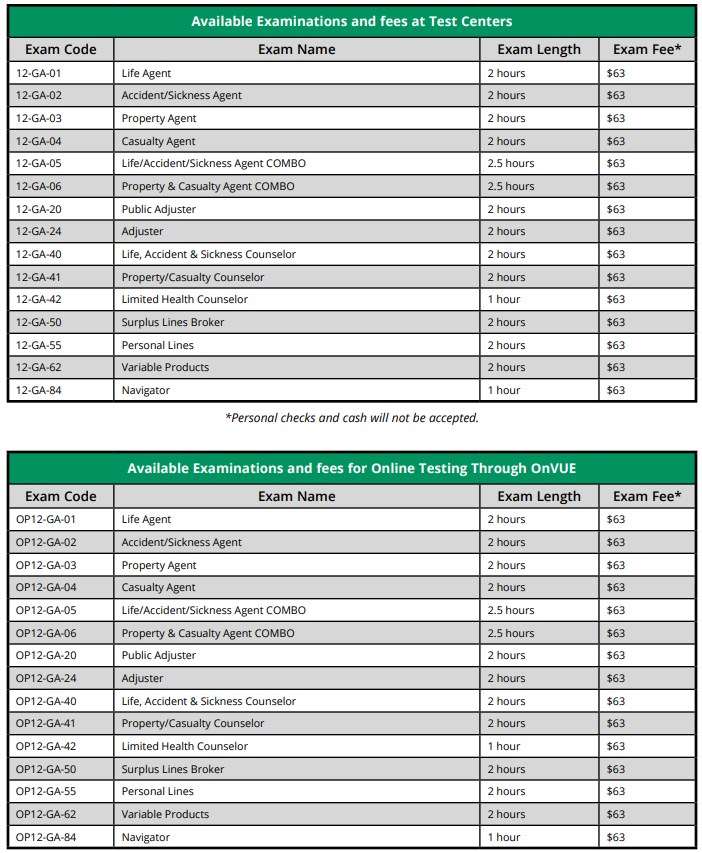

How To Pass The Georgia Insurance Licensing Exam Americasprofessor Com

Georgia Food Stamps Income Limit 2021 2022 Georgia Food Stamps Help

A Fetus Counts As A Dependent On State Tax Returns In Georgia Npr

Ga Food Stamp Calculator For 2022 Georgia Food Stamps Help

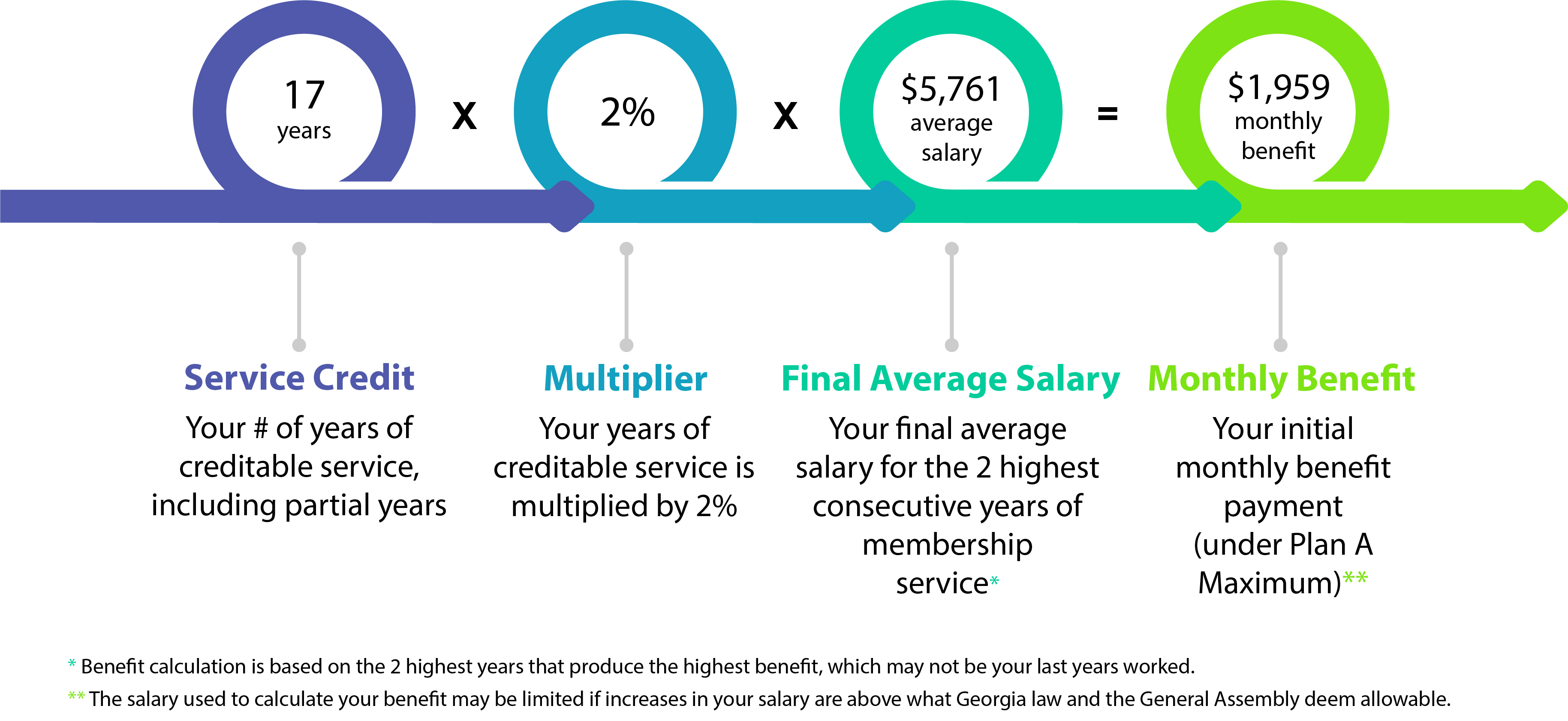

Teachers Retirement System Of Georgia Trsga

Georgia Paycheck Calculator 2022 With Income Tax Brackets Investomatica

How To Calculate Child Support In Georgia 2018 How Much Payments

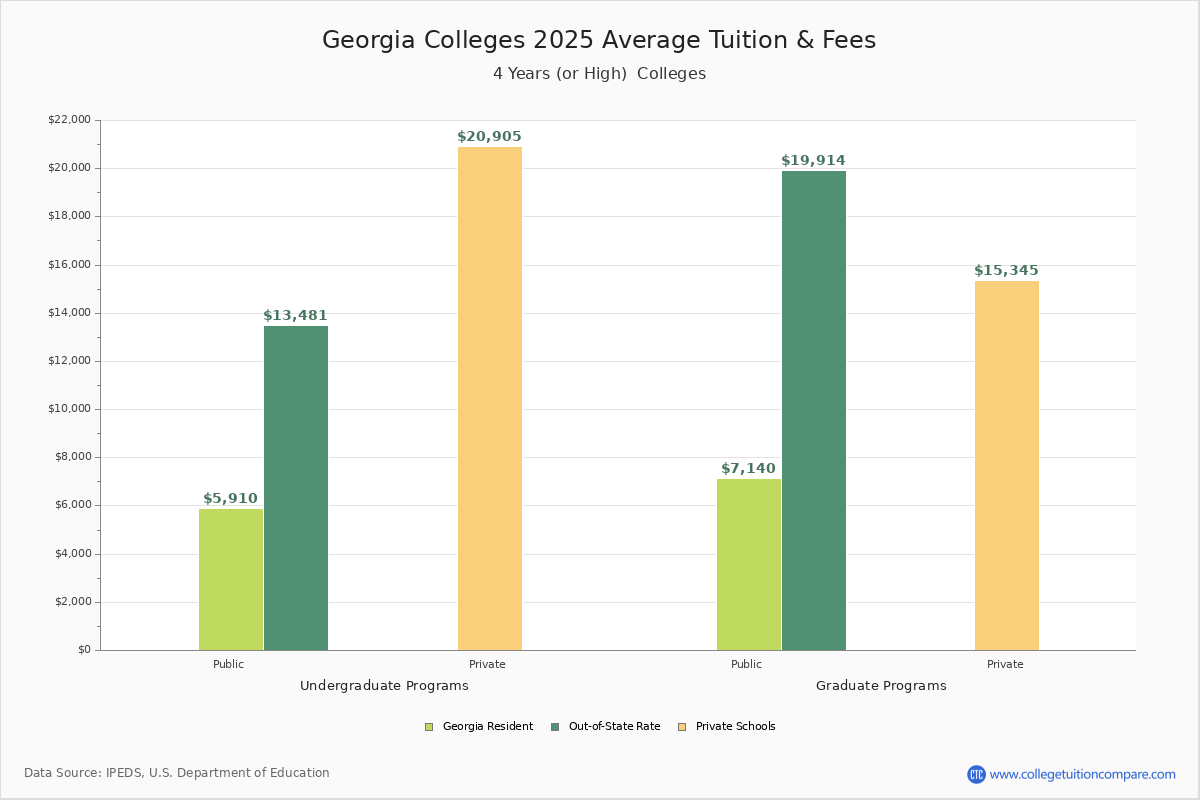

Georgia Colleges 2022 Tuition Comparison

Georgia Paycheck Calculator Smartasset

Collective Review An Honest Review Of The S Corp Back Office Tax Platform Upwork Tax Services Graphic Design Tips

Payroll Software Solution For Georgia Small Business